Title: Ensuring the Legitimacy of Your Refinance Transactions: The Indispensable Role of ID Verification in a Mobile Notary Signing Agent’s World

As an experienced mobile notary signing agent, I routinely navigate the intricate landscape of real estate transactions, including refinancing loans. Over the years, I’ve fielded numerous queries from borrowers about one seemingly minor detail that actually carries significant importance. Many ask, “Do you need 2 forms of ID for notary?” or “How many forms of ID for notary?” The answer, particularly in the context of refinancing, is yes – two forms of identification are required. While this requirement may initially appear as an added inconvenience, it’s a crucial element underpinning the validity and security of these transactions. This article aims to demystify why this measure is vital and how it protects all involved parties.

Dual Verification: The First Line of Defense

The cornerstone reason for requiring two forms of identification lies in verifying the borrower’s identity. As a notary signing agent, my prime responsibility is to confirm that the person signing the documents is indeed who they claim to be. This dual identification process creates a solid layer of security beneficial to all parties – the borrower, the lender, and me, the notary. This measure actively reduces potential for identity theft and fraud, thereby safeguarding the integrity of the transaction.

An Extra Layer of Protection for the Public Record

Beyond witnessing the signing of legal documents, notary signing agents perform a crucial function of verifying the identities of the involved parties, which becomes a part of the public record. Our seals and signatures attest to the fact that we’ve conducted due diligence to authenticate the signers’ identities. By insisting on two forms of identification, we strengthen this public record, adding an extra layer of verification and reliability.

Legal Mandate: A Requirement We Must Adhere To

The requirement of two forms of identification is not a mere recommendation. In many jurisdictions, it’s a legal necessity for notary signing agents to obtain satisfactory proof of identity before notarizing documents. Failure to comply can lead to severe consequences, including the loss of our commission, financial penalties, or even criminal charges in extreme cases.

Mitigating Errors and Future Disputes

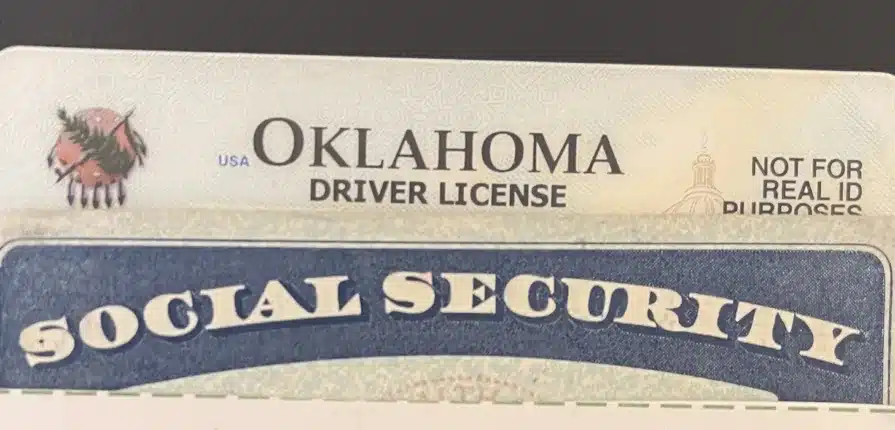

The presentation of two forms of identification minimizes the risk of identification errors, thereby reducing potential disputes in the future. Many borrowers wonder, “What is the best form of identification for a notary?” The most reliable forms are government-issued IDs like driver’s licenses, passports, and military IDs because they offer comprehensive proof of identity, helping the notary to ensure that the person in front of them is indeed the person named on the documents.

Lender and Title Company Requirements: The Extra Mile

Often, lenders and title companies impose their own rules to enhance protection against fraudulent activities. These rules frequently exceed state requirements, calling for borrowers to present two forms of identification. These additional precautions offer an extra layer of security, further bolstering the integrity of the refinance process.

No ID? Exploring Alternatives

While it might seem impossible to get something notarized without ID, some jurisdictions allow the use of credible witnesses known to both the signer and the notary, who can vouch for the signer’s identity. Moreover, with the advent of online notarization, you might wonder about “online notary without ID”. While online notary services still require ID verification, this often takes the form of knowledge-based authentication questions or credential analysis rather than physical ID inspection.

In Conclusion: The Value of Double Identification in Refinancing

While presenting two forms of identification during a refinance transaction might seem like an extra step, the importance of this requirement is paramount. It is an integral procedure that ensures the transaction’s credibility, reduces fraud risks, and fortifies the integrity of the public record.

As a dedicated and seasoned mobile notary signing agent, my mission extends beyond facilitating transactions. It involves educating borrowers about these requirements and why they matter. The extra step of providing two forms of identification is a small one, yet it plays a crucial role in protecting your interests as a borrower. Understanding the reasons behind these necessities will make you a more informed participant in the refinancing process, empowering you to navigate these transactions with greater confidence and ease.